Business Insurance in and around Liberty

Looking for small business insurance coverage?

This small business insurance is not risky

State Farm Understands Small Businesses.

When you're a business owner, there's so much to take into account. You're in good company. State Farm agent Seth Crow is a business owner, too. Let Seth Crow help you make sure that your business is properly covered. You won't regret it!

Looking for small business insurance coverage?

This small business insurance is not risky

Get Down To Business With State Farm

If you're looking for a business policy that can help cover buildings you own, accounts receivable, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

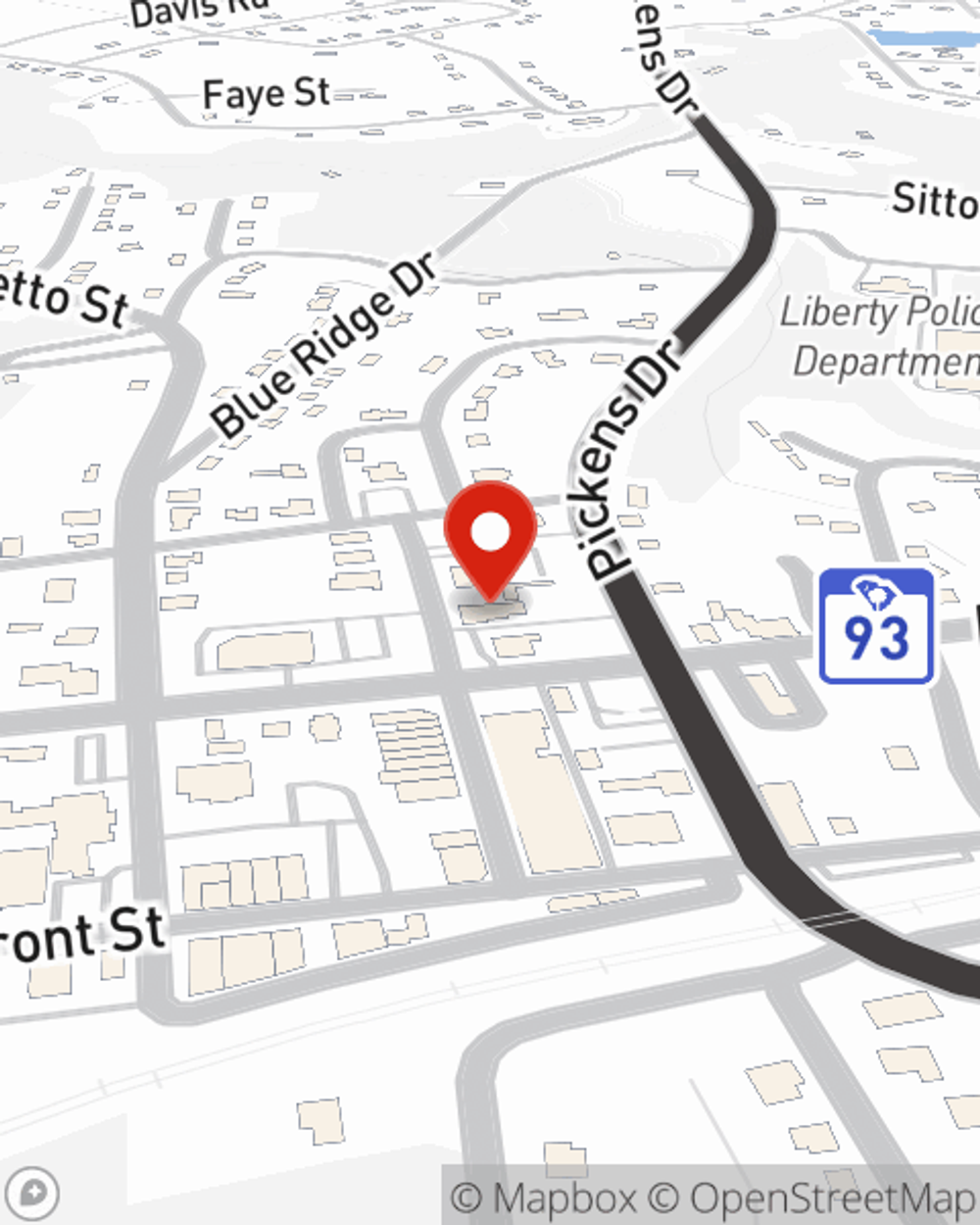

Contact State Farm agent Seth Crow today to learn more about how a State Farm small business policy can safeguard your future here in Liberty, SC.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Seth Crow

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.